Healthy overall market indicators: Lower oil costs balanced by labour shortage challenges

By Nate Boe

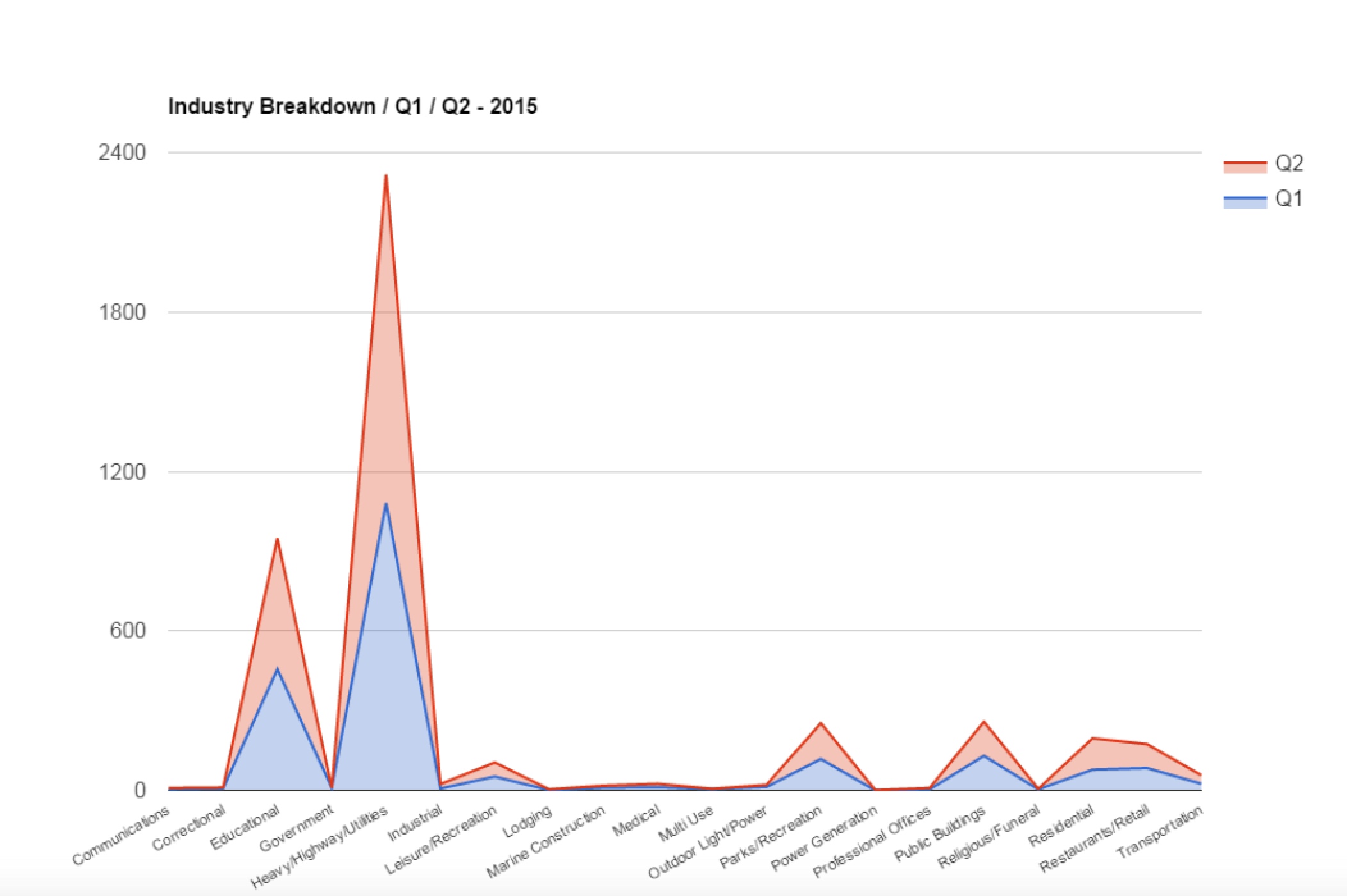

A significant increase in public and private sector construction opportunities in the past quarter – with major increases from last year’s same quarter – indicates a healthy Chicagoland construction industry market, according to leads service DataBid.com’s quarterly update.

Lower gasoline prices, which generally correlate with reduced construction material prices, have been offset by higher labor costs because of labor shortages.

Second quarter oil prices noticed declines due increased supply compared to growing global demand. As of July 7, 2015, oil prices have dropped below $54 per barrel.

“The national average gas price could return to nearly $2 a gallon later this year,” said Tom Kloza, chief oil analyst at the Oil Price Information Service. The national average is currently hovering around $2.77. Construction materials prices traditionally drop in correlation with oil, but higher overall demand across most major construction segments has kept prices at sustained levels.

Current shipping costs are also play a role but unfortunately they are not acting as a positive combined force and remain high due to labor shortages, which continue to negate some of oil price savings.

We do observe a nice increase in the overall number private sector construction bids when compared to this same time last year. In the second quarter of 2014 there were 139 private sector projects with due dates from April 1 thru June 30. This year private sector construction bids surge and are up roughly 80 per cent over Q1 of 2015.

| Q1 2015 | Q2 2015 | |

| Total | 2,101 | 2,352 |

| Private Sector Construction Bids | 170 | 242 |

| Public Sector Construction Bids | 1931 | 2110 |

| Industries | ||

| Communications | 4 | 5 |

| Correctional | 7 | 4 |

| Educational | 456 | 493 |

| Government | 10 | 0 |

| Heavy/Highway/Utilities | 1,081 | 1,236 |

| Industrial | 7 | 17 |

| Leisure/Recreation | 52 | 53 |

| Lodging | 1 | 3 |

| Marine Construction | 10 | 8 |

| Medical | 12 | 13 |

| Multi Use | 5 | 1 |

| Outdoor Light/Power | 13 | 8 |

| Parks/Recreation | 118 | 135 |

| Power Generation | 0 | 1 |

| Professional Offices | 4 | 5 |

| Public Buildings | 130 | 128 |

| Religious/Funeral | 4 | 2 |

| Residential | 78 | 118 |

| Restaurants/Retail | 84 | 90 |

| Transportation | 25 | 32 |

Industrial and multi-unit residential construction bids are up this quarter over last, with industrial projects up more than double compared to Q1 of 2015 and Q2 of 2014. The public sector continues to dominate many of the projects making up roughly 90 per cent of the work going out for bid compared to the private sector in both Q-1 and Q-2 of 2015.

Please follow and subscribe to the DataBid Chicago Quarterly Bulletin as we continue to follow and chart opportunities within the public and private sector of the Chicagoland Market.

To see current projects please visit: DataBid.com or Call: 888-929-3282